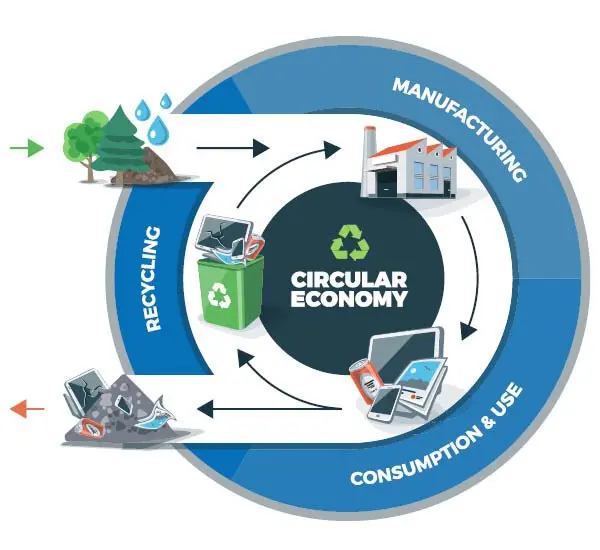

The Circular Economy is a prominent theme among producers, processors, users and recyclers of plastics, especially in the multifaceted field of packaging.

Circular Economy – A Golden Opportunity, Not Just an Obligation

We all know about its significance for the environment and people alike. However, many of those involved have lacked the drive to implement the necessary measures because ultimately it has to be a worthwhile investment, and these days that is often not the case – if the state does not take accompanying supporting measures. This could change in the foreseeable future, as international developments and EU regulations set clear goals that not only benefit the environment but also open up attractive opportunities for recyclers. What is decisive here is the word ‘all’, which, as always with absolute concepts, represents an ideal that cannot be realistically attained – however, it is an ideal that the entire chain must come much closer to realising in the future than it is today. The necessary pressure is currently coming from China and the EU.

China and the EU are forcing us to think again

In the past, it was possible to conveniently sell substantial amounts of plastic waste – such as films and mixed plastics – to China. As part of the ‘National Sword’ campaign against importing untreated waste, China is putting an end to this practice as of the end of this year. For many waste management companies here in Europe as well as e.g. in the USA or Japan, this is a real challenge and they are having to rethink their business models. Moving away from disposal and towards recovering more materials is also the EU Commission’s declared objective, which sets ambitious goals for material recycling. As things stand at present, it aims to achieve a 55% recycling rate for plastic packaging by 2025. In comparison, the current (2014) recycling rate for plastics packaging waste in Europe is around 28%.

More supply means more opportunities

China’s initiative will increase the supply of recyclable waste plastics in this country, which in turn will depress the achievable prices. This development is rather counterproductive for the EU’s goal of increasing the recycling rate. But as there are two sides to every coin, qualified recycling companies will be on the winning side of this development in the long term. They will face a growing supply of waste plastics, enabling them to raise their own standards. In other words, they will be able to impose higher quality requirements on the input material, thereby reducing its sorting and processing costs and ultimately offering the market larger quantities of higher quality recyclates at better prices. In this regard, the expected initiatives of the packaging industry and major brands to promote recyclable designs will also be beneficial, as will intensified efforts in collection logistics to enable improved waste sorting.

The bottom line is that the future holds attractive opportunities for plastics recyclers. The development is foreseeable and its consequences will soon be felt. This means that those waste management companies that want to take advantage of these opportunities in the future already have their programme laid out for them. Only those who check the efficiency of their plants today and, if necessary, bring them up to par will be able to cost-effectively produce high-quality, marketable output in sufficient quantities tomorrow. And those companies that have sufficient space to not only modernise but also expand their facilities will be able to benefit fully from the growing supply of input material and hence increase their market share.